high low method machine hours

Use the high-low method to determine the hospitals cost equation using nursing hours as the cost driver. Example of High-Low Method.

Plant activity is best measured by direct labor hours.

. Using the highlow method of analysis the estimated variable cost per machine hour is. Quarter Work hours Cost 1 15000 4000000 2 20000 4800000 3 18000 4400000 4 21000 5000000. The total maintenance cost at 25000 machine hours is given as.

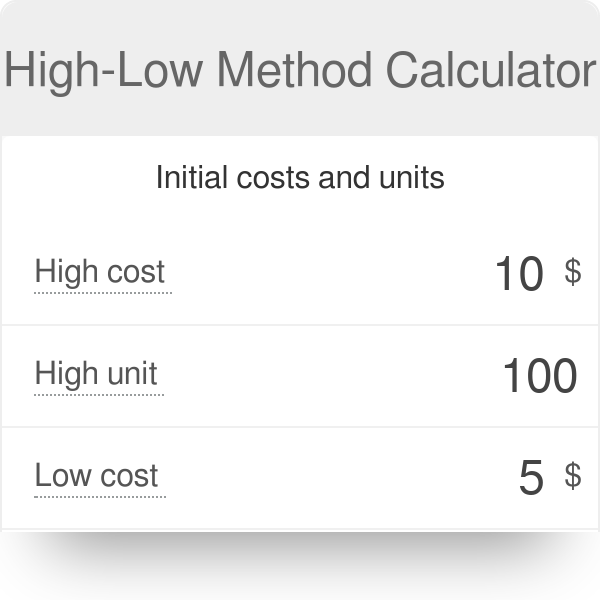

High-Low method is one of the several mathematical techniques used in managerial accounting to split a mixed cost into its fixed and variable components. Machine-hours Labor Costs Highest observation of cost driver 400 10000 Lowest observation of cost driver 240 6800 2. Month Direct Labor Hours Maintenance Cost January 1700 14300.

Related

The highest and the. Uses the highlow method to analyze cost behavior. The Hunter Company uses the high-low method to estimate the cost function.

The use of such a relationship of total factory overhead to changes in machine hours is said to be valid only within the relevant range which means. Hotlanta Inc which uses the high-low method to analyze cost behavior has determined that machine hours best explain the companys utilities cost. Machine Hours 22000 32000 26000 24000 Cost 56000 May June July August Oa.

Period Semi-Variable Costs Machine Hours 1 100000 22000 2 120000 30000 3 96000 23600 If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total A. Variable utilities cost per machine hour Change in costhigh machine hour-low machine hour 4076-33881460-1030 Variable utilities cost per machine hour 16 per machine hour 2 Fixed cost Total cost-variable cost 3388- 103016 Fixed cost 1740. 11000 76000 58000 66000.

When activityjumped to 25000 machine hours which. What is the estimate of the total cost when 300 machine-hours are used. The organization increments salaries and wages by 10 at the start of the 3rd.

Advertisement Advertisement New questions in Business. The companys relevant range of activity varies from a low of 600 machine hours to a high of 1100 machine hours with the following data being available for the first six months of the year. Machine-Hours Maintenance Costs Highest observation of cost driver 140000 280000 Lowest observation of cost driver 95000 190000 Difference 45000 90000 Maintenance costs a b Machine-hours Slope coefficient b 90000 45000 2 per machine-hour Constant a 280000 280000 0 or Constant a 190000.

Show more Accounting Business Managerial Accounting MANAGERIAL 4711. Recent data are shown below. 1 CALCULATE VARIABLE UTILITIES COST PER MACHINE HOUR.

In cost accounting a way of attempting to separate out fixed and variable costs given a limited amount of data. Machine hours 24000 15000. X Company uses the high-low method to estimate total overhead costs each month with machine hours as the activity measure.

A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver. Machine Hours Electrical Cost January 4000 3120 February 6000 4460 March 4800 3500. Units labor hours machine hours etc and the corresponding total cost figures high-low method only takes two extreme data pairs ie.

Total costsfixed costsvariable cost. The following past monthly cost and activity information is available. To solve this using the high-low method formula subtract the lower cost from the higher cost to get a numerator of 27675 then subtract the lowest number of units from the highest quantity to.

A manufacturing company estimates semi-variable costs by using the high-low method with machine hours as the cost driver. Month May June July August Cost 5846 8829 9850 8908 Machine Hours 1800 3700 4350 3750 If machine hours in October are expected to be 2700 what are. Cost per month 39200 32000.

Assume that the relevant range includes all of the activity levels mentioned in this problem. The information for 20x3 is provided below. I Give short introduction of the professions in tourism sector.

So the answer is a. The company wants to know the rate at which its electricity cost changes when the number of machine hours change. The formula used in computing the rate is.

If Casablanca expects to incur 185000 machine hours next month what will the estimated total overhead cost be using the high-low method. Assume that the cost of electricity at a small manufacturing facility is a mixed cost since the company has only one electricity meter for air quality cooling lighting and for its production equipment. The company observed that at 21000 machine hours of activity total maintenance costs averaged 3620 per hour.

Based on the following information calculate fixed costs per month using the high-low method. Recent data are shown below. HIGH-LOW METHOD Key Terms and Concepts to Know Variable Fixed and Mixed Costs.

If factory overhead is Rs 3 00000 and total machine hours are 1500 the machine hour rate is Rs 200 per machine hour Rs 3 00000 1500 hours. The total predicted overhead costs for the month is 489500. If 29000 machine hours were budgeted for the next period estimated semi-variable costs would total.

The high-low method involves taking the highest level of activity. High Low Method is a mathematical technique used to determine the fixed and variable elements of historical costs that are partially fixed and partially variable. Round the variable cost to the nearest cent y 1310 x 162000 Predict total overhead costs if 25 comma 00025000 nursing hours are predicted for the month.

Given a set of data pairs of activity levels ie.

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

Application Of Ensemble Machine Learning Algorithms On Lifestyle Factors And Wearables For Cardiovascular Risk Prediction Scientific Reports

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Air Changes Per Hour Calculator Cfm Based Formula Examples

Straight Line Depreciation Formula Guide To Calculate Depreciation

High Low Method Learn How To Create A High Low Cost Model

Top Deep Learning Interview Questions Answers For 2022 Simplilearn

High Low Method Learn How To Create A High Low Cost Model

Double Declining Balance Method Of Deprecitiation Formula Examples

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Splitting Machine Learning Data Train Validation Test Set Split

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting

High Low Method Calculate Variable Cost Per Unit And Fixed Cost

Cost Behavior Analysis Analyzing Costs And Activities Example

Compare And Contrast Traditional And Activity Based Costing Systems Principles Of Accounting Volume 2 Managerial Accounting